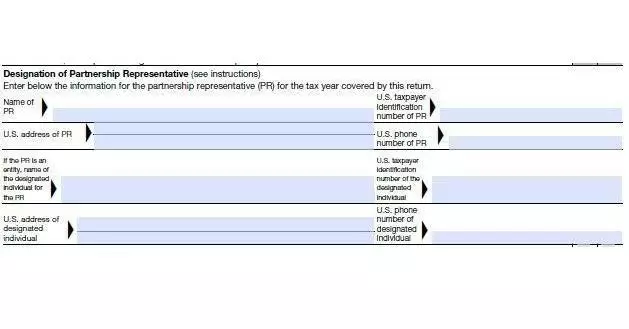

Partnerships and LLCs that applied to extend their deadline for filing Form 1065 for the 2018 tax year have until September 16, 2019 to submit their return. This deadline is fast approaching, and given recent changes to the partnership audit process, it is important for partnerships to ensure that they can meet their filing requirements by this date. In particular, the Bipartisan Budget Act of 2015 now requires partnerships to appoint a “partnership representative,?? who will have the power to bind the partnership and all partners to any audit determinations. This representative can be appointed from within the partnership or from without. However, since the representative will serve as the partnership’s liaison with the Internal Revenue Service, he or she should be somebody who has extensive knowledge of partnership tax law and who has experience interacting with the IRS. Indeed, federal regulations require the representative to maintain a “substantial presence?? in the United States: he or she must be available to meet with the IRS in person, must have a United States street address and a phone number with the United States area code, and must have a United States taxpayer identification number. Foreign partnerships, including hedge funds and private equity funds, can satisfy this requirement by appointing experienced United States tax attorneys to act as their representatives. An attorney representative will make sure that the partnership is adequately prepared to meet its filing requirements and that the partnership is skillfully represented before the IRS in the case of audit. Due to the attorney-client privilege, attorney representatives will also be free to communicate openly with the partnership at all stages in the filing process. Thus, partnerships that appoint an attorney representative need not worry that their communication with their representative could be accessed by the IRS in the case of an audit.

Caplin & Drysdale is an industry-leading tax firm founded by a former Commissioner of the IRS and headquartered in Washington, D.C. Our senior tax lawyers have held government tax positions in the Department of Treasury, the IRS, and the Tax Division of the Department of Justice, and have decades of experience with IRS examinations of partnerships.

A New Era of Partnership Representation Before the IRS

Search

Recent Blog Posts

- Surge in BBA Partnership Audits Expected in 2022

- IRS Releases Memo Concerning Access to Administrative File in TEFRA and BBA Examinations

- IRS Provides Penalty Relief for New Capital Reporting Requirements

- IRS Releases Proposed Regulations on Centralized Partnership Audit Regime

- Centralized Partnership Audit Regime Website Launched by IRS

- Partnership Filing Relief

- IRS Issues LB&I Memorandum

- IRS Release Clarifications for Form 8082

- IRS Release Draft Instructions to Form 8978

- IRS Releases Interim Guidance Centralized Partnership Audit Regime

Bios

Archives

- January 2022

- April 2021

- January 2021

- November 2020

- September 2020

- April 2020

- March 2020

- February 2020

- November 2019

- October 2019

- July 2019

- March 2019

- January 2019

- December 2018

- November 2018

- September 2018

- January 2018

- October 2017

- August 2017

- July 2017

- May 2017

- February 2017

- January 2017

- November 2016

- October 2016

- September 2016

- August 2016